Auto Finance Made Simple: Your Guide to Smarter Car Buying

Buying a car is one of the biggest financial decisions most people will make, and for many, it’s not something that can be done with cash alone. That’s where auto finance comes into play. Whether you’re considering a brand-new model or a used vehicle, understanding the basics of financiamiento automotriz (auto financing) is crucial for making smarter car-buying decisions.

This guide breaks down everything you need to know—from loan options and interest rates to tips on saving money—so you can drive away with confidence.

What Is Auto Finance?

Auto finance refers to the process of borrowing money to purchase a vehicle. Instead of paying the full amount upfront, you take out a loan or lease agreement and repay it over time. The lender—such as a bank, credit union, or dealership—charges interest on the borrowed amount.

In Spanish-speaking regions, the term financiamiento automotriz is commonly used, and it covers a variety of financial products tailored to car buyers. Understanding these options allows you to compare and choose the one that best suits your budget and long-term financial goals.

Types of Auto Financing

When it comes to buying a car, there are several financing paths you can take:

- Car Loans

- The most common option. You borrow money from a bank, credit union, or online lender and repay it in monthly installments. Ownership of the BMW X2 Singapore transfers to you immediately, but the lender has a lien until the loan is fully repaid.

- Dealership Financing

- Many car dealerships offer in-house financiamiento automotriz. While convenient, interest rates may be higher than those of independent lenders. Always compare offers before committing.

- Many car dealerships offer in-house financiamiento automotriz. While convenient, interest rates may be higher than those of independent lenders. Always compare offers before committing.

- Leasing

- Instead of buying, you rent the car for a fixed period (usually 2–4 years). Leasing often results in lower monthly payments but does not give you ownership at the end of the term unless you choose a buyout option.

- Instead of buying, you rent the car for a fixed period (usually 2–4 years). Leasing often results in lower monthly payments but does not give you ownership at the end of the term unless you choose a buyout option.

- Balloon Payments

- A loan structure where you pay smaller monthly installments but make a large final payment at the end. This is common in some markets but requires careful planning.

- A loan structure where you pay smaller monthly installments but make a large final payment at the end. This is common in some markets but requires careful planning.

Key Factors in Auto Finance

When evaluating financiamiento automotriz, consider these critical elements:

- Interest Rate (APR): Determines how much extra you’ll pay over the loan term. A lower rate means significant savings.

- Loan Term: Ranges from 24 to 84 months. Longer terms reduce monthly payments but increase total interest.

- Down Payment: The upfront amount you pay. A larger down payment lowers monthly costs and reduces risk.

- Credit Score: A major factor in securing favorable rates. Good credit often means better loan terms.

Tips for Smarter Auto Financing

- Set a Budget First

Determine how much you can realistically afford before walking into a dealership. Include insurance, fuel, and maintenance costs in your calculation. - Compare Multiple Offers

Never settle for the first financing option. Shop around and compare rates from banks, credit unions, and online lenders. - Negotiate the Car Price, Not Just the Loan

Some buyers focus only on monthly payments, but negotiating the actual car price can save you thousands. - Avoid Long Loan Terms if Possible

While longer loans lower monthly payments, they often result in paying much more over time. Aim for the shortest term that fits your budget. - Read the Fine Print

Pay attention to hidden fees, prepayment penalties, and insurance requirements attached to the financing agreement.

The Role of Financiamiento Automotriz in Car Buying

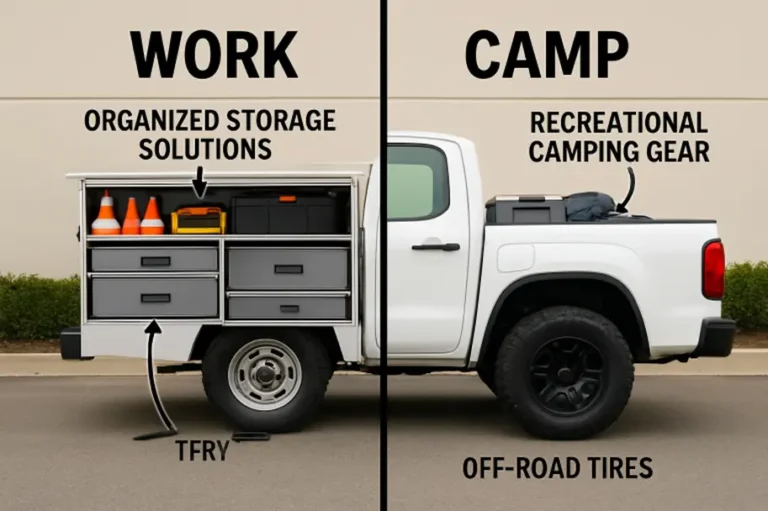

In regions where financiamiento automotriz is widely used, buyers have access to diverse loan structures designed for flexibility. For instance, some programs cater to first-time buyers with little credit history, while others provide tailored plans for luxury cars or commercial vehicles.

Understanding local financial products helps buyers choose wisely and avoid pitfalls such as predatory lending or overly complex loan terms.

Future of Auto Financing

The auto finance industry is evolving with technology. Online platforms now allow buyers to pre-qualify, compare, and even finalize loans without stepping into a bank. Additionally, digital tools make it easier to calculate payments, track credit scores, and manage repayments.

In the future, sustainable financing models may emerge, especially with the rise of electric vehicles. Flexible plans like subscription services could also change how people think about car ownership.

Conclusion

Auto finance doesn’t have to be overwhelming. By understanding your options and carefully evaluating terms, you can make informed decisions that align with your financial goals. Whether you’re considering a traditional loan, a lease, or dealership financing, remember to compare offers, negotiate wisely, and budget responsibly.